Estimated reading time: 3 minutes

Table of contents

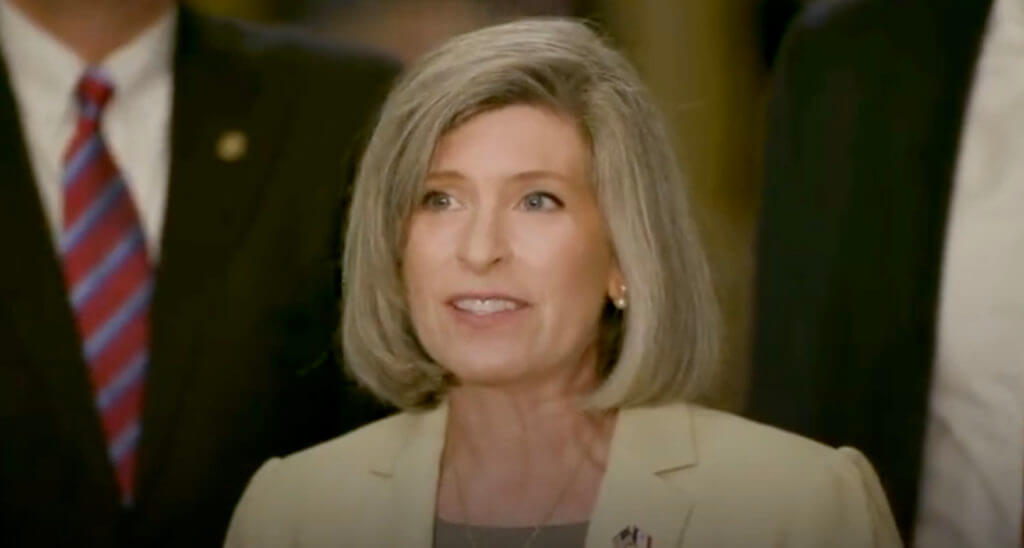

It’s not every day that you hear about the IRS packing heat. But that’s exactly what’s been happening, to the tune of $35.2 million. Iowa’s Senator Joni Ernst is saying enough is enough.

Ernst, the straight-shooting Republican, is spearheading a move to disarm the IRS. Yes, you heard it right. She’s calling out the tax agency for splurging taxpayer dollars on weapons, ammunition, and military-grade gear.

Since 2006, the IRS has been spending wildly. They’ve spent over $35.2 million on an arsenal that would make some small countries blush. They’ve dropped $10 million on weaponry and gear since 2020 alone.

Sen. Ernst Calls ‘Em Out

“The taxman is fully loaded at the expense of the taxpayer,” Ernst said in a press release obtained by GunsAmerica. “As the Biden administration has worked to expand the size of the IRS, any further weaponization of this federal agency against hardworking Americans and small businesses is a grave concern.”

“I’m working to disarm the IRS and return these dollars to address reckless spending in Washington,” she added.

Those Hilarious Training Videos From Last Year

they're training 87,000 more of these pic.twitter.com/4HfejkaClX

— Citizen Free Press (@CitizenFreePres) August 17, 2022

The IRS has assembled 87,000 of the softest nerds, narcs, dorks, geeks, and tattle tellers in history the history of dweebs pic.twitter.com/e61Lq7IHHb

— Andrew McCarthy (@AMcCarthyNY) August 17, 2022

SEE ALSO: IRS to Hire 87,000 Agents, Some Will Need to ‘Carry a firearm and be willing to use deadly force, if necessary

These are not auditions for the next Police Academy sequel. This is an actual IRS recruiting program: pic.twitter.com/KUFqxmbDpW

— Thomas Massie (@RepThomasMassie) August 16, 2022

Why Is the IRS Playing War

The question that’s tickling everyone’s mind is, why is the IRS playing at war?

According to Adam Andrzejewski, CEO of Open the Books, the IRS isn’t just buying handguns for self-defense. They’ve been stocking AR-style rifles, semi-automatic shotguns, and even submachine guns. They’ve also stockpiled 5 million rounds.

“The IRS special agent is starting to look less like a desk worker or rule maker and more like a SWAT team from a Hollywood thriller. It’s the blurring of the lines between a tax agency and traditional law enforcement,” observed Andrzejewski.

The Why Does the IRS Have Guns Act Would:

- Prohibit the IRS from buying, receiving, or storing guns and ammo,

- Transfer all guns and ammo currently in the IRS’ possession to the General Services Administration,

- Auction off these guns and ammo to Federal Firearms License owners and devote proceeds to deficit reduction, and

- Relocate the IRS Criminal Investigation Division within the Justice Department.

Ernst is doing more than just talking. She’s proposed the ‘Why Does the IRS Have Guns Act.’ The act would prohibit the IRS from buying, receiving, or storing guns and ammo. It would also force the IRS to offload its existing arsenal.

But here’s the kicker. The act stipulates that all this weaponry should be auctioned off to Federal Firearms License owners. And the money raised? It’ll be used for deficit reduction. A classic two-birds-one-stone move.

Furthermore, Ernst wants to relocate the IRS Criminal Investigation Division. She wants it under the Justice Department, where traditional law enforcement belongs.

This move is a stand against wasteful spending and overreach. Ernst is making a clear point: the IRS is a tax agency, not a paramilitary organization. The time has come to ask ourselves, why does the IRS need guns?

And, Ernst isn’t just demanding answers, she’s making moves and leading the charge for change – it’s high time someone stepped up to the plate.

Fox News Video

*** Buy and Sell on GunsAmerica! All Local Sales are FREE! ***